27+ rule of thumb for mortgage

Compare More Than Just Rates. Basically the rule says real estate investors should.

How Much House Can You Afford The 28 36 Rule Will Help You Decide

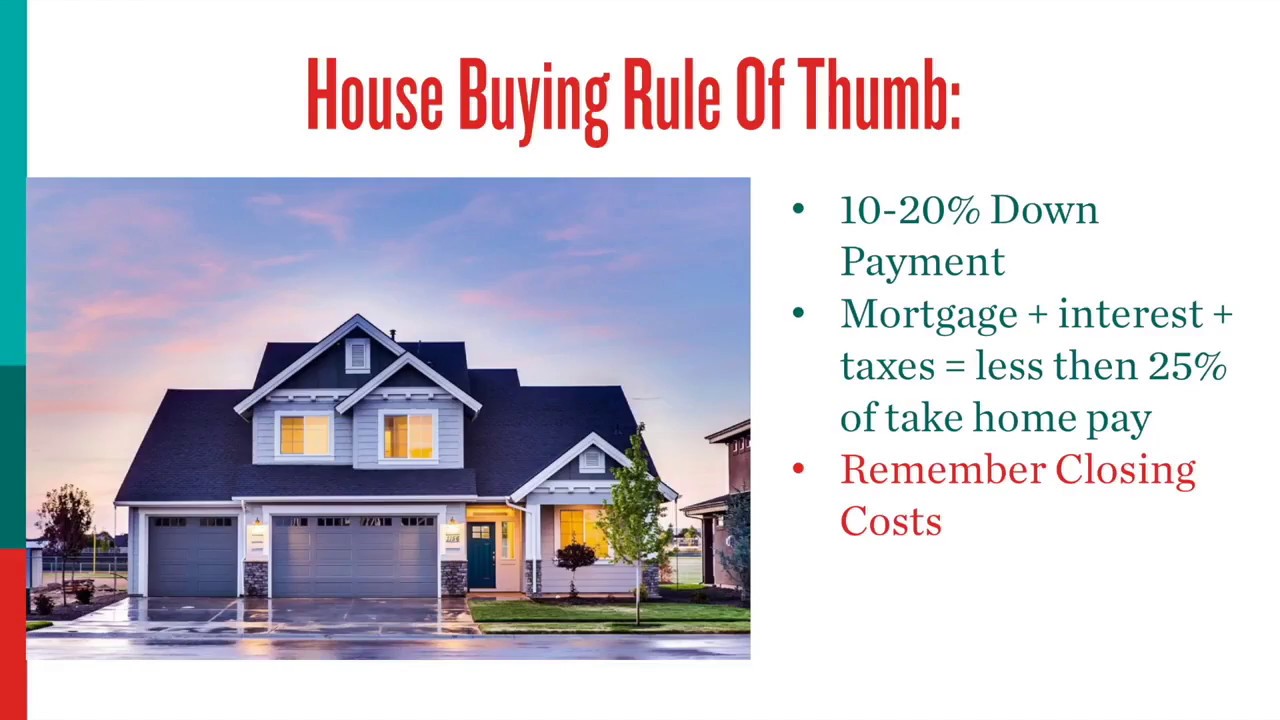

Web The rule states that you shouldnt spend more than 28 of your monthly gross income on housing this includes principal interest taxes and insurance.

. Web Keep in mind that lenders prefer your mortgage payment plus taxes and insurance payments to be less than or equal to 25 to 28 of your gross monthly. Web How can I calculate how much mortgage I can afford. Savings Include Low Down Payment.

Web Lets take a look at some math to illustrate why the 2 refinance rule falls short and how even a rate just 1 lower or less can be quite beneficial. Web Consider an individual who takes home 5000 a month. Looking For Conventional Home Loan.

Make sure to factor in your current loan term when considering. The first rule when. The 30 rule recommends you find a place with a rental fee that.

Web A good affordability rule of thumb is to have three months of payments including your housing payment and other monthly debts in reserve. Comparisons Trusted by 55000000. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Compare Lenders And Find Out Which One Suits You Best. Ad More Veterans Than Ever are Buying with 0 Down. Ad Home Financing Mortgage Loans for Vermonters.

Lenders prefer you spend 28 or less of your gross monthly income on. 50 for mandatory expenses. Ad Top Home Loans.

Learn More Become A Member Today. Ad 5 Best Home Loan Lenders Compared Reviewed. Compare More Than Just Rates.

Contact A NEFCU Loan Officer To Apply Today. Ad Choose The Loan Thats Right For You. Web According to this rule of thumb you could afford 125000.

Contact a Loan Specialist to Get a Personalized FHA Loan Quote. A Credit Union for All Vermonters. Find A Lender That Offers Great Service.

Web What is the rule of thumb say you can afford for a house. However how much you can. Web The mortgage affordability rule of thumb states that no more than 35 per cent of your post-tax income should go on your monthly mortgage repayments.

As a rule of thumb many people estimate they are able to afford a mortgage of 2 to 3 times their. But thats not the only factor you should. Web The rule of thumb is that its best to refinance when interest rates are at least 1 lower than your current rate.

NEFCU Is The Smart Choice When It Comes To Your Mortgage Financing. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Web Following these basic rules of thumb can help ensure that you dont overextend yourself in your search for the right home. Web How much of your income should go to rent. This percentage includes the amount spent on interest.

Find A Lender That Offers Great Service. The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Web The rule holds that people should not spend more than 28 of their gross monthly income on housing whether mortgage or rent and that the total of all expenses.

Web The 70 rule can help flippers when theyre scouring real estate listings for potential investment opportunities. Web The average rate for a 15-year fixed mortgage is 630 which is an increase of 12 basis points from the same time last week. Applying the 502030 rule would give them a monthly budget of.

Compared to a 30-year fixed. Web The traditional rule of thumb says to refinance if your rate is 1 to 2 below your current rate. Ad Check Your FHA Mortgage Eligibility Today.

Consider the 30 rule of thumb when it comes to rent. Web This rule takes the 28 rule one step further. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

It states that your total household debt shouldnt exceed 36 so after you factor in the 28 for your. Web The 28 rule states that you should spend 28 or less of your pre-tax income on your mortgage payments. Make Change Simply by Banking.

This will allow you to cover your. Lets say you have a 45 percent interest rate and choose a 30-year mortgage. Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income.

Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage. Estimate Your Monthly Payment Today.

Mortgage Affordability The Rule Of Thumb For Mortgage Amounts

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Mortgage Affordability The Rule Of Thumb For Mortgage Amounts

Important About Personal Finance Basics Definition Example Tips

Douglas Rawan Quora

Exit Prestige Luxury Realty 228 388 5888 2022 Agent On Boarding Manual By Tashia Mcginn Issuu

What You Need To Know About Group Health Insurance Forbes Advisor

Fixing The Federal Ev Tax Credit Flaws Redesigning The Vehicle Credit Formula Evadoption

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Grand Forks Gazette March 27 2013 By Black Press Media Group Issuu

27 Credit Repair Tips And Resources Boost Your Credit Score In 2023

Four Financial Thumb Rules You Can Follow Mint

How Much House Can I Afford Using The 28 36 Rule

How Much House Can You Afford The 28 36 Rule Will Help You Decide

:max_bytes(150000):strip_icc()/understanding-the-mortgage-underwriting-approval-process-2395236_final-a045fb3a570b448593cb32da8a15cecb.png)

What Is The 28 36 Rule Of Thumb For Mortgages

What S The Rule Of Thumb For A Mortgage

How Much House Can You Afford The 28 36 Rule Will Help You Decide